Explain Different Cost Plus Pricing Method

This method is used in construction business professions and even for consumer goods. The markup is the percentage of profit calculated on total cost ie.

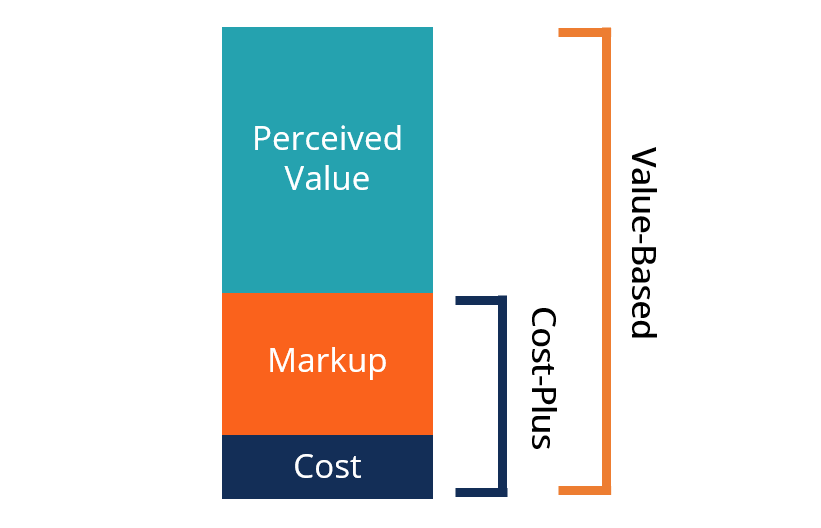

Value Based Pricing Overview How It Works Issues

These two types of cost-based pricing are as follows.

. Simple in its application the cost-plus pricing method allows you to pass all costs to your customer regardless of the product or service. It is also called mark-up pricing and means nothing else than adding a standard markup to the cost of the product. Then a market-based markupthe plus in cost plusis added to the total to account for an appropriate profit.

To use the cost-plus pricing method take your total costs direct labor costs manufacturing shipping etc and add the profit percentage to create a single unit price. It is the simplest method of determining the price of the product. 2 Markup Pricing.

Cost-plus pricing 9750. Lets say you run an ecommerce store that sells candles. Cost plus pricing involves adding a markup to the cost of goods and services to arrive at a selling price.

Transfer Pricing Method 3. Cost plus pricing method refers to that pricing strategy under which the company adds all costs which has gone into making a product like raw material labor and then firm add some percentage of profit margin to arrive at a price for a product. The Cost Plus Method Edit September 2018.

Re-written to explain this method better The Cost Plus Method compares gross profits to the cost of sales. While its a transaction-based method it is less direct than other transactional methods and there are some similarities to the profit-based methods. This is one of the simplest pricing strategies.

In short look at how much it costs you to make a product and multiply that by a fixed percentage to get your selling price. In this method the price includes a certain percentage of profit margin on the sum total of the full cost of production marketing costs and an allocation of the overheads ie. How to use the cost-plus pricing formula.

Types of Cost-Based Pricing. In cost-plus pricing method a fixed percentage also called mark-up percentage of the total cost as a profit is added to the total cost to set the price. It is one of the simplest pricing method wherein the manufacturer calculates the cost of production incurred and add a certain percentage of markup to it to realize the selling price.

Cost-plus pricing is where a business comes up with prices by multiplying its cost of goods sold by the desired markup percentage. Refers to the simplest method of determining the price of a product. The cost plus method CPLM works by comparing a companys gross profits to the overall cost of sales.

It refers to a pricing method in which the fixed amount or percentage of. Cost plus pricing also known as full cost approach or markup pricing is a common method of pricing. We can also call it the average cost pricing.

Cost-plus pricing. Cost Oriented Pricing Method It is the base for evaluating the price of the finished goods and most of the company. Cost-plus pricing is the simplest pricing method.

The pricing method is divided into two parts. A firm calculates the cost of producing the product and adds on a percentage profit to that price to give the selling price. In highly competitive markets it can be hard for new companies to get a foothold.

Lawyers accountants and other professionals typically price by adding a simple standard markup to their costs using this simple cost-based. Cost-Plus Pricing- In this pricing the manufacturer calculates the cost of production. The method can be used only when company has necessary data about various costs and expected sales.

In cost-plus pricing method. It is a form of cost-plus pricing but here the profit margin is presented as a percentage of expected. The first full cost pricing takes into consideration both variable and fixed costs and adds a markup.

Full Cost Pricing is based on the estimated unit cost of the product with the normal level of production and sales and usually adopted by manufacturer firms. Under this a company adds a fixed percentage of the total cost as mark-up to come up with the selling price. The name says it all.

It starts by figuring out the costs incurred by the supplier in a controlled transaction between affiliated companies. The Cost Plus Method. The other is direct cost pricing which is variable costs plus a markup.

A certain percentage of cost is. This appears in two forms. Cost-plus pricing is the simplest pricing method.

Given below are some of the advantages and disadvantages of cost plus pricing. Cost-plus pricing break-even price profit margin goal. While simple it is less than ideal for anything but physical products.

To use the cost-plus pricing. Cost-Based Pricing Classification Formulas 1 Cost-Plus Pricing. A profit margin is added to this unit cost.

The above example of the mobile explains cost-plus pricing. The model ignores market and customer data and sets a price based on costs which best ensures you will recoup those costs and make a profit. It costs you 10 to make every candle including materials and labor.

This pricing strategy focuses on internal factors like production cost rather than external factors like consumer demand and competitor prices. The first step is to determine the costs incurred by the supplier in a controlled transaction for products transferred to an associated purchaser. In this method a standard mark-up or profit margin is added to the product costs.

The method is also known as cost-plus pricing. Many product-based businesses eg retail use this pricing strategy for simplicity. Cost-plus pricing 78 125.

Cost-Oriented Methods Cost Plus Pricing. The cost plus transfer pricing method is a traditional transaction method which means it is based on markups observed in third party transactions. You just take the product production cost and add a certain percentage to it.

How The Cost Plus Transfer Pricing Method Works. Cost-plus pricing is one of the simplest ways of price determination. Of course the standard markup should account for the profit.

A cost-plus pricing strategy or markup pricing strategy is a simple pricing method where a fixed percentage is added on top of the production cost for one unit of product unit cost. This methods of pricing use standard costing techniques and work out the variable cost and fixed costs involved in manufacturing selling and administering the. Fixed and variable cost.

Generally there are four types of cost-based pricing. Under this approach you add together the direct material cost direct labor cost and overhead costs for a product and add to it a markup percentage in order to derive the price of the product.

Cost Plus Pricing Simplest Method To Determine Your Prices Prisynccom Blogengage Cost Plus Price Method

What Are The Pricing Methods Definition And Meaning Business Jargons

No comments for "Explain Different Cost Plus Pricing Method"

Post a Comment